Investors don't understand Meta [Markets]

A deepdive into the Metaverse, Open Source, and how Meta is tackling their biggest challenges.

It takes time to create work that’s clear, independent, and genuinely useful. If you’ve found value in this newsletter, consider becoming a paid subscriber. It helps me dive deeper into research, reach more people, stay free from ads/hidden agendas, and supports my crippling chocolate milk addiction. We run on a “pay what you can” model—so if you believe in the mission, there’s likely a plan that fits (over here).

Every subscription helps me stay independent, avoid clickbait, and focus on depth over noise, and I deeply appreciate everyone who chooses to support our cult.

PS – Supporting this work doesn’t have to come out of your pocket. If you read this as part of your professional development, you can use this email template to request reimbursement for your subscription.

Every month, the Chocolate Milk Cult reaches over a million Builders, Investors, Policy Makers, Leaders, and more. If you’d like to meet other members of our community, please fill out this contact form here (I will never sell your data nor will I make intros w/o your explicit permission)- https://forms.gle/Pi1pGLuS1FmzXoLr6

Meta’s recent quarter was a bloodbath for the bears. In Q2 2025, the company delivered revenue of $47.52 billion (a 22% year-over-year jump) and earnings of $7.14 per share — smashing estimates of roughly $44.5 billion and $5.75 EPS. The stock responded in kind, ripping higher by double digits in after‑hours trading.

Now remember where the chorus was not long ago: TikTok siphoning attention, a metaverse spend that looked bottomless,a 2022 face-plant, and open-source AI with “no ROI,” all caused Meta’s obituaries prewritten. Chamath Palihapitiya even laid out a public short case on Facebook/Google back in 2020 — regulation, stagnation, structural decay. (For a bit of personal lore around me, one of my first articles was about this topic, a theme I would explore much more in future articles. These articles are a huge reason why my newsletter became popular in investor circles.)

So why do Market Analysts get Meta so wrong, so regularly?

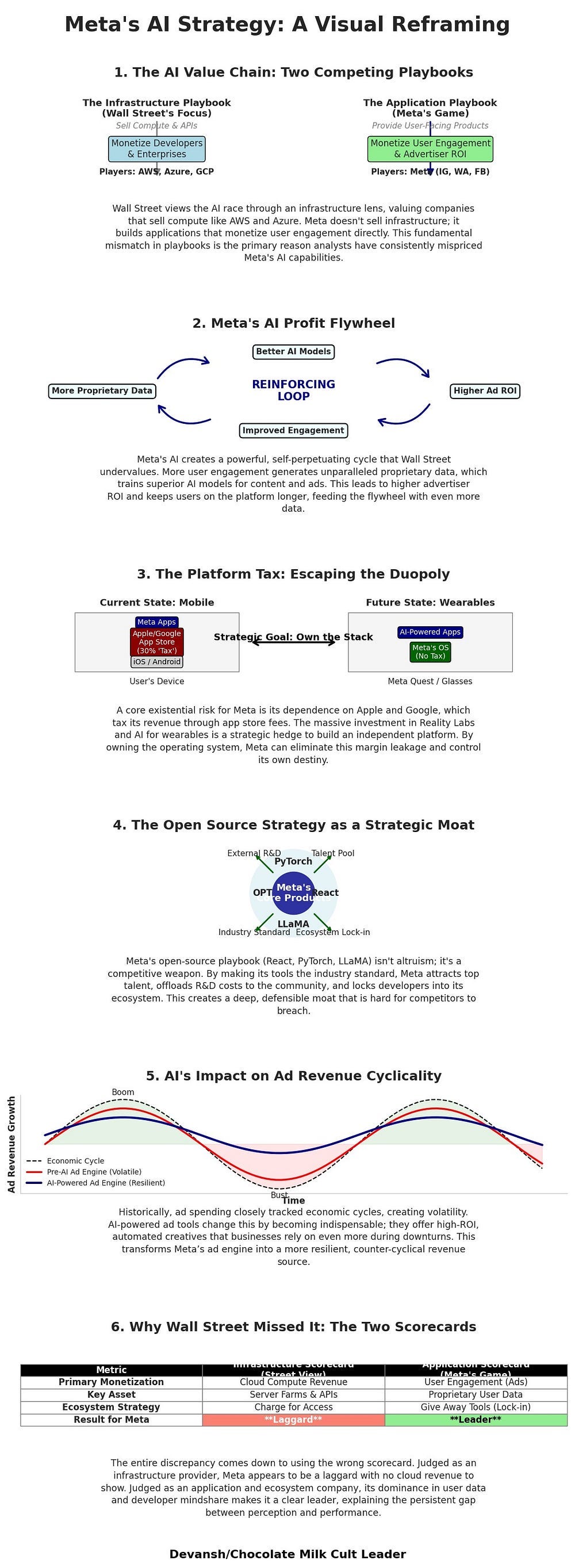

Put simply: Wall Street models implicitly Meta like an infra provider (their superficial similarity to Google doesn’t help here). But Meta isn’t trying to be that. They have a completely different gameplay.

In this article, we will-

Analyze the Meta Ecosystem to understand why they make money and their biggest challenges.

Place their major investments (open source AI, Metaverse, etc) in the larger context of their strategy.

Demonstrate how analysts overweight infra monetization and underweight ecosystem strategy — the core reason behind their inability to price Meta correctly.

Change my name to David b/c I’m about to rock your world. If by the end of this masterpiece you’re not begging to have my kids, I’ll refund your money.

Executive Highlights (TL;DR of the Article)

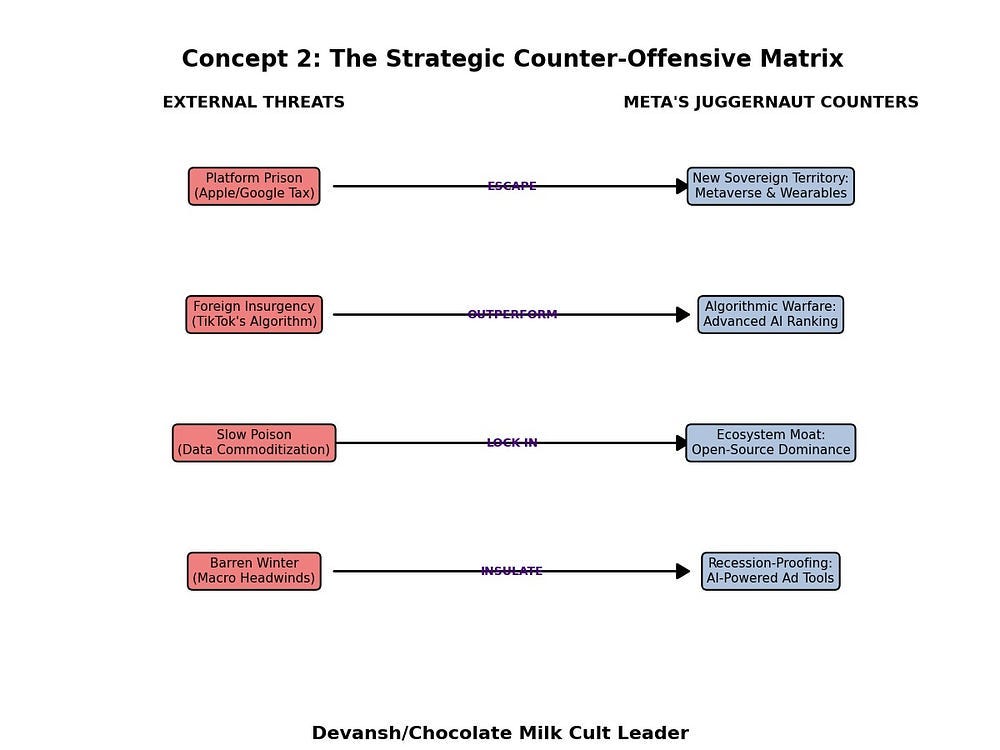

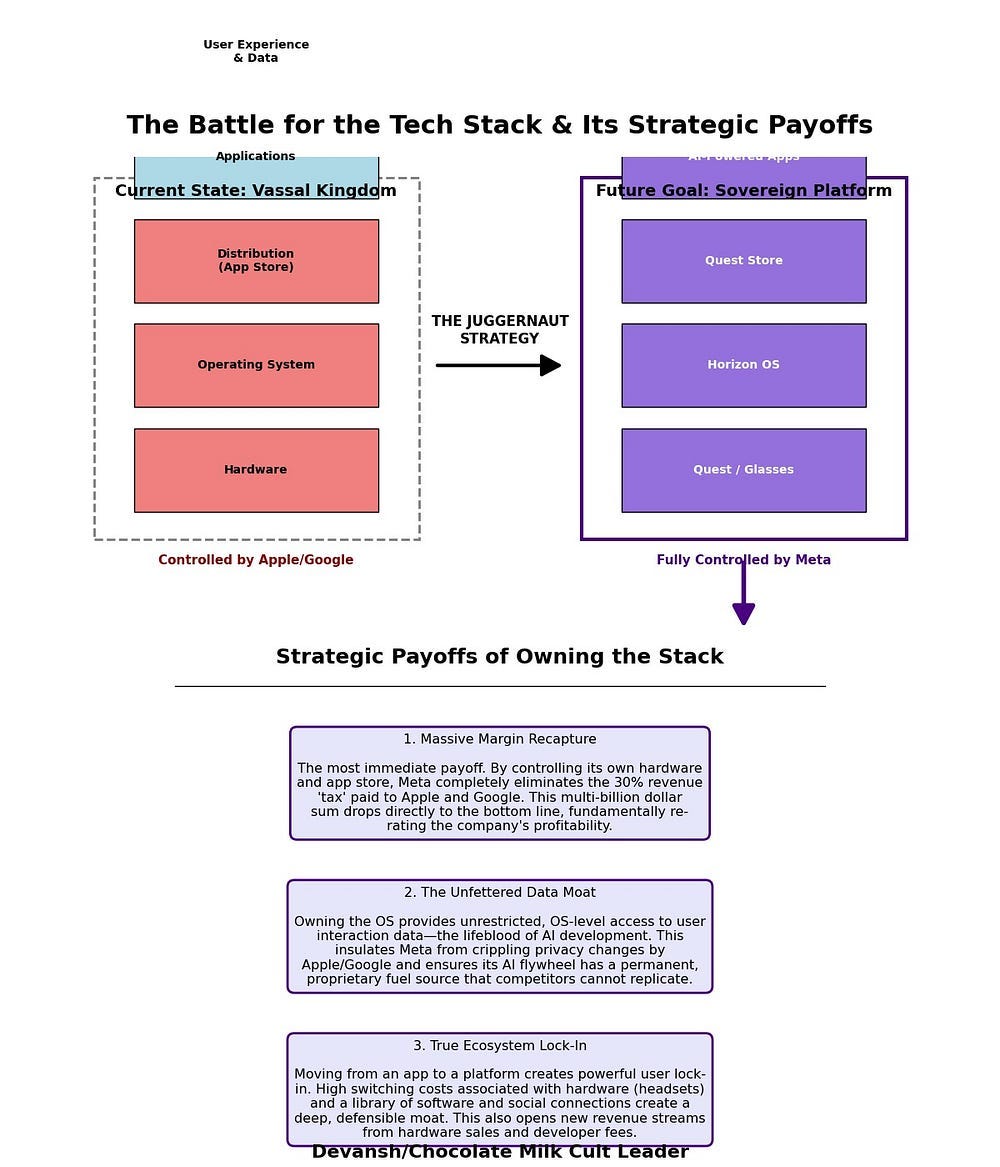

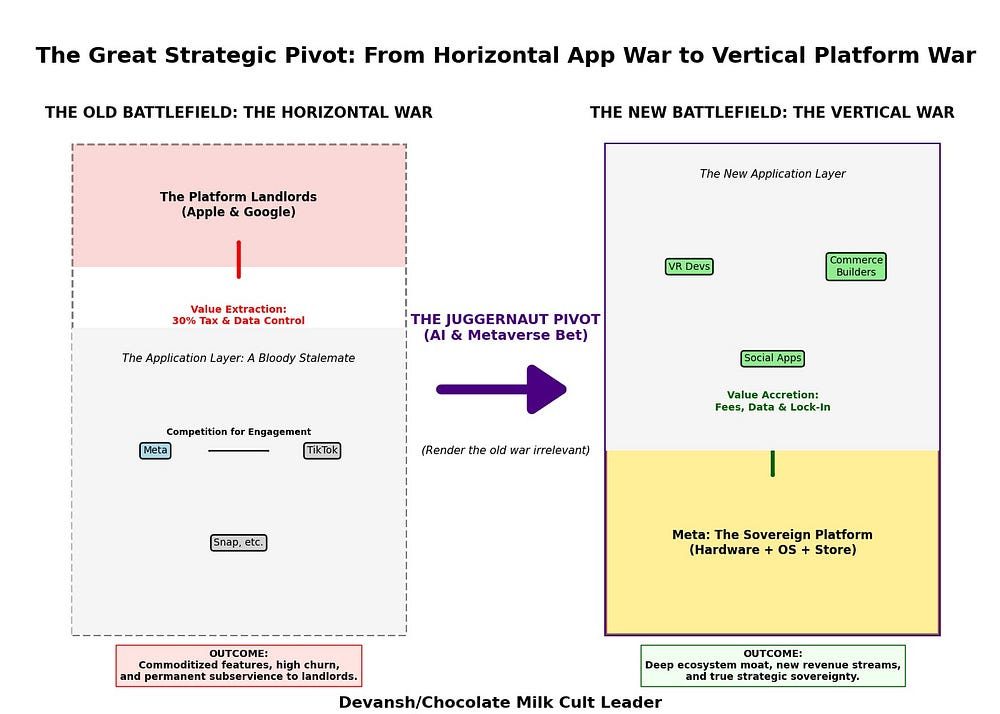

Meta’s primary existential threat is its status as a vassal to Apple and Google, forced to pay a 30% platform tax that subordinates its future. This threat is the prime mover for its entire grand strategy.

To solve this, Meta launched a two-front war:

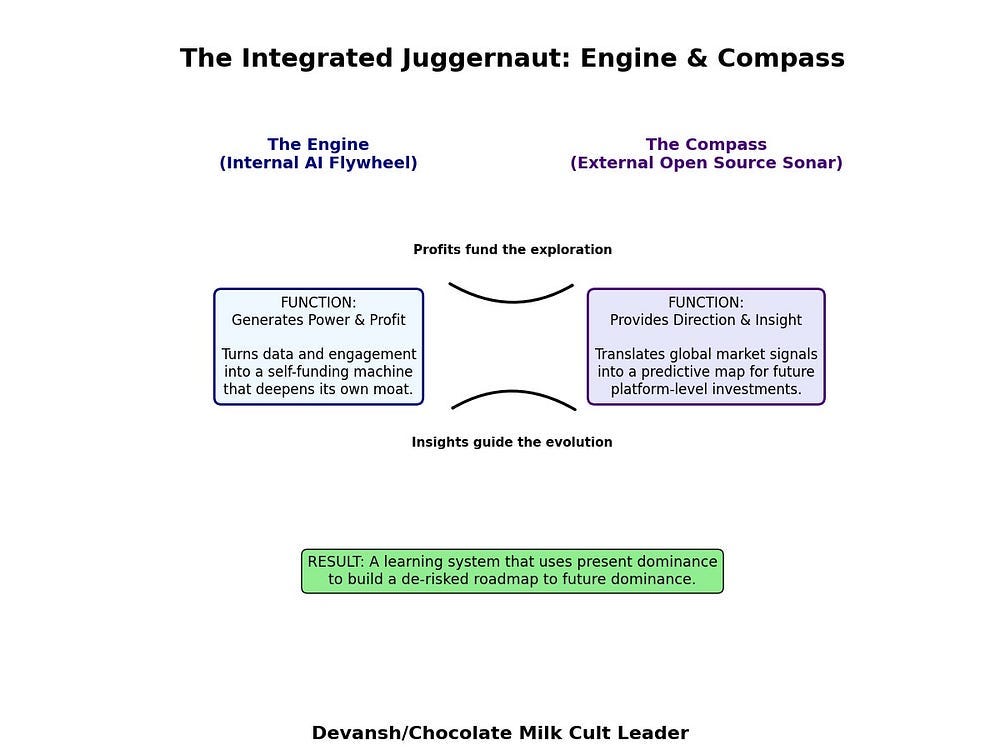

The Internal Engine: It perfected a self-funding “AI Flywheel” where better AI drives hyper-efficient ad targeting, which boosts revenue, which funds more AI R&D, which increases user engagement, generating more data to feed the AI. This engine funds the entire operation.

The External Weapon: It weaponized open source (React, PyTorch, LLaMA) not as charity, but as a tool for mass-scale outsourced R&D and, more critically, as a “market sonar” to see where the future is being built and shape the ecosystem to its advantage.

These two fronts serve a single endgame: sovereignty. The billions burned in Reality Labs are not a speculative waste; they are the explicit cost of escaping the Apple/Google prison and building a new, independent computing platform (the “Metaverse”). The goal is to invert the App Store playbook, becoming the landlord who collects the tax, not the tenant who pays it.

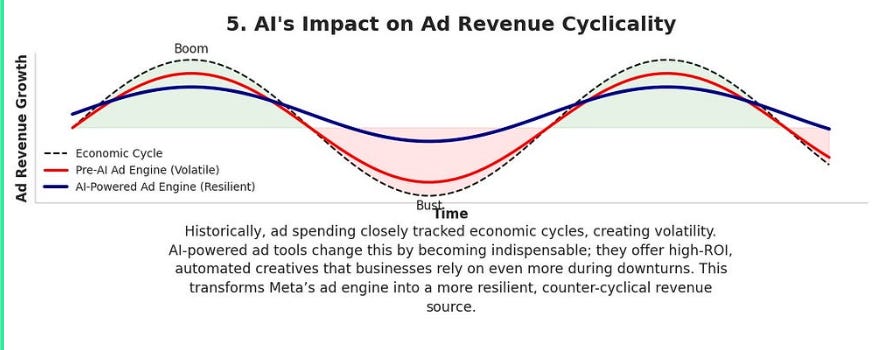

A key consequence of the AI Flywheel is that Meta’s core business has become counter-cyclical. In economic downturns, businesses rely more on their automated, high-ROI ad tools as a substitute for labor, making their revenue far more resilient than historical models predict.

The persistent mispricing occurs because analysts fixate on the quantifiable risks (the platform tax, the Reality Labs burn) while being strategically blind to this cohesive, multi-step plan. They are valuing a company waging a war for a new continent by the standards of a merchant renting a stall, too caught up in their simplistic metrics to see the deeper ecosystem plays beneath.

I put a lot of work into writing this newsletter. To do so, I rely on you for support. If a few more people choose to become paid subscribers, the Chocolate Milk Cult can continue to provide high-quality and accessible education and opportunities to anyone who needs it. If you think this mission is worth contributing to, please consider a premium subscription. You can do so for less than the cost of a Netflix Subscription (pay what you want here).

I provide various consulting and advisory services. If you‘d like to explore how we can work together, reach out to me through any of my socials over here or reply to this email.

Part 1: The Gilded Cage of Meta’s Ecosystem

To understand the violence of Meta’s ambition, we must first understand the architecture of its prison. Meta, for all its billions in revenue, is a vassal kingdom. It built a sprawling empire on land it doesn’t own. Land that it pays for. Land it does not control.

The landlords, of course, are Apple and Google.

No matter what flavor of mental disease you choose to indulge in from the Buffet in Zucky chans Empire of Joy, one factor is consistent — you have to access Meta apps from someone else’s platform. Apple decides that rent-seeking is easier than building something that people love? Enjoy your 30% tax (a real thing; Google it). Google and Apple decide they don’t want you collecting data? Goodbye to tens of Billions in Sales Revenue.

From the outside, the picture looks rosy enough. But make no mistake, Meta is in a prison, always relying on their platform providers for access.

But the jailers at the gate are not the only threat. Zucky chan has to deal with a few other issues —

The Foreign Insurgency: TikTok provides another powerful social media platform where people can reach customers, undercutting Meta’s strong hold on advertisers. This drives down margins. The rise of Substack and other newsletter platforms promises to do similar things.

The Slow Poison: Commoditization. Data is no longer as unique as it once was. Successful apps, Big Tech Companies (including Reddit and Amazon), and other Social Media platforms (including LinkedIn now) are all building up powerful user profiles. Add to this the rise of influencer marketing and endorsements, where value is harder to capture for the platforms hosting content, and we must confront the increasing commoditization of data.

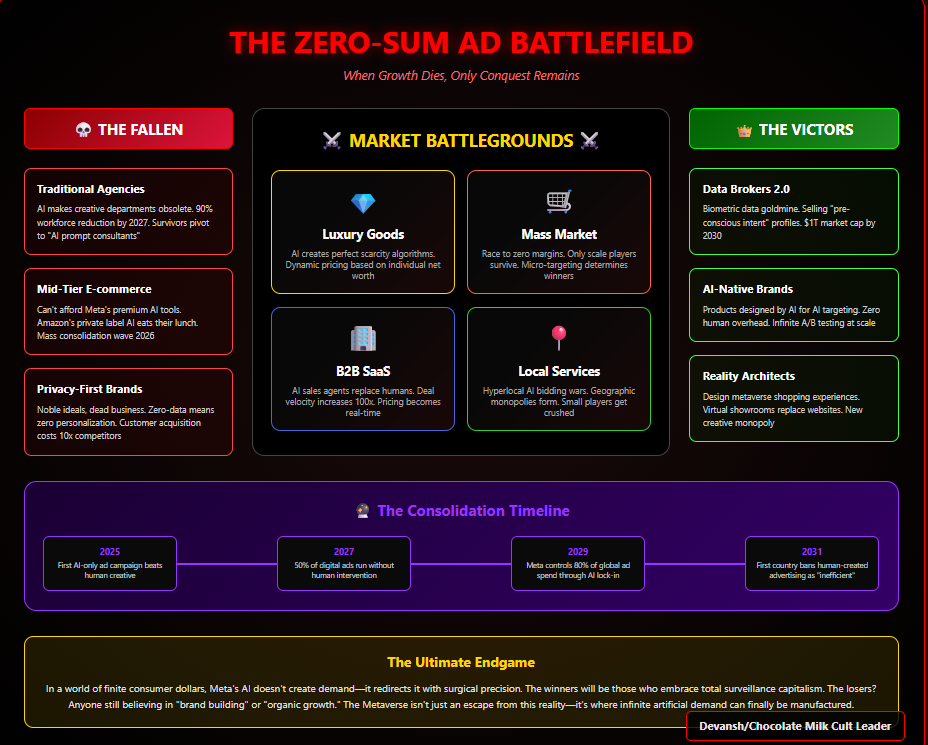

The Barren Winter: On top of it all, the economy has begun to cool. Rising interest rates and inflation choked disposable income. A shrinking pie turns a competitive market into a bloody, zero-sum knife fight.

Faced with this multi-front war, most companies would focus on defense. Cut costs, slash R&D, do anything to survive. Zucky-chan, to his credit, is not an unimaginative hack that beats it to Jack Welch as profound business advice. Instead of adjusting to the prison, he decided to Juggernaut his way out; come what may.

Part 2: Meta’s Two-Front War for Independence

The cost-cutting described above is the playbook of a merchant, described earlier. Meta is playing the game of an empire.

Instead of building walls, Zuckerberg began forging a two-pronged weapon designed not just to survive the war, but to reshape the entire battlefield to his advantage. This requires two pillars of execution.

Front One: The Internal Engine (The AI Flywheel)

The first front was to perfect the core. Meta’s business has always been a machine for converting attention into revenue. Their various AI investments have been a key piece to building a self-sustaining loop.

It works like this:

Better AI ingests trillions of data points, achieving a near-telepathic understanding of user desire.

This leads to Hyper-Efficient Profiling, which one shots consumers into buying shit.

Advertisers see an insane ROI and pour more money into the system, boosting Meta’s Revenue.

This revenue funds More AI R&D, which makes the models even more powerful.

Simultaneously, this AI is used for Content Moderation, creating cleaner, more addictive feeds that increase User Engagement.

More engagement generates More Data.

Go back to step 1.

This is the aspect that most people are familiar with. And this is generally where their insight on Meta ends. However, that understanding is incomplete. Step 1 is merely the engine. The expansion comes from their next play.

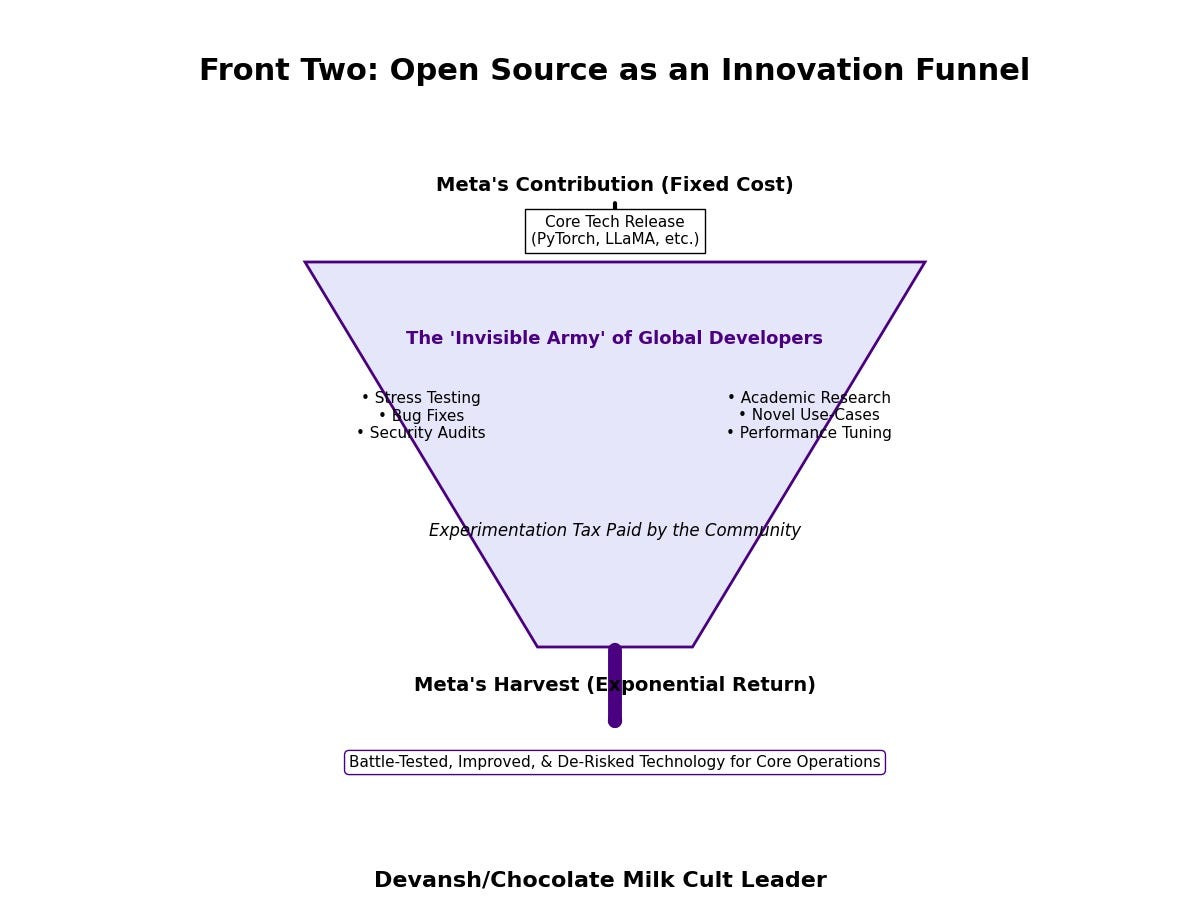

Front Two: Open Source as Market Maker

React. PyTorch. OPT. LLaMA. All immensely valuable. All open source. To the casual observer, these look like acts of generosity — Meta tossing billion-dollar assets into the public square. In reality, this is outsourced R&D at scale.

The important thing to realize is that there was no getting around the cost of developing these solutions. They had to be developed precisely because existing solutions could not solve Meta’s unique challenges. But by open-sourcing, they recruit an invisible army. Researchers, builders, and enthusiasts all poke, prod, and improve the stack.

Meta folds the best work back into its internal operations, where it matters most: ad targeting, moderation, and internal productivity. The world pays the experimentation tax; Meta reaps the operational benefit.

Additionally, open-source does something subtler: it acts as market sonar. React wasn’t built for VR. It just had some advantages that builders in the OSS community spotted, and they naturally shifted more of their VR building to it. A few thousand ant-lifetimes later, React was the best platform for AR/VR, and Facebook had a strong foundation to switch battlegrounds. Facebook became Meta, and the rest is history.

Now when React extensions start flourishing in VR, Meta knows exactly where to push hardware next. When PyTorch dominates academic labs, Meta knows where the research talent will flow. The ecosystem tells them the future before the market prices it in. If you’ve ever wondered how our market research is always ahead of the curve, that is your answer. We have extensive investments in monitoring OS communities and GitHub repos, which tell us what works, for whom, and what the challenges are.

This monitoring allows us to build forward-facing estimates, instead of relying on building backdated models with sketchy assumptions. In a shifty field like AI, that’s game-breaking. Yes, I dropped some elite ball knowledge. You’re welcome.

To reiterate on what is a very important point-

Meta’s Open Source projects aren’t altruism. It’s the surveillance of innovation itself — watching the world build, and using those signals to steer billion-dollar bets.

When I explain this principle to my investor clients, one of the most common questions I get is why doesn’t Meta follow Google/Amazon playbook of monetizing Llama while opening a weaker model? I can’t blame the clients for asking this question b/c they’re constantly exposed to mouth-breathers pretending to be tech analysts, who can’t see Meta past very crude categories like “FAANG” and “AI Hyperscaler”. However, this framing misunderstands Meta’s role in the tech ecosystem. Bigly. Very Bigly.

Why would attempting to sell LLaMA as a service be a strategic blunder? LLM inference is a high-cost, low-margin nightmare. Meta has no competitive advantage in the cloud infrastructure game; they would be a third-rate player entering a bloodbath against established giants like AWS and GCP, and a swarm of specialized startups like Together, CoreWeave, Lambda etc. Setting up the infrastructure to be half decent (a non-negotiable given the brand risk) would be a major distraction away from their main goal. This is one of the many ways investors misprice Meta by looking at it from as an Infra company, not as an apps company. More will come in the next sections.

Part 3: The Endgame — Meta wants Purna Swaraj

The engine funds the war. The open-source ecosystem expands the field. Both fronts serve one purpose: escape.

Meta’s ultimate goal is not incremental ad efficiency. It’s sovereignty. As long as Apple and Google control distribution, Meta remains a tenant on rented land. Every improvement to its ad machine or AI stack just fattens the tribute it owes the landlords. To break the cycle, Meta has to build its own territory.

That’s the real meaning of the Metaverse and Reality Labs. Not a vanity project. Not a side-bet. A new continent where Apple’s tax and Google’s gatekeepers do not exist. Billions in losses are simply the price of independence.

Meta’s sovereignty doesn’t stop at escape. Once Meta builds the platform, others will build on top of it. Developers creating VR apps, social environments, and commerce layers expand the value of the ecosystem — and in doing so, reinforce their own dependence. It’s the App Store playbook, inverted: instead of being trapped by Apple’s walls, Meta becomes the landlord. Each new builder makes the platform more valuable, harder to abandon, and more dominant over time.

And here is the final, elegant cruelty of this plan: it renders the old wars irrelevant. Vertical short form, stories, and trending pages were all easy to copy, leading to the commoditization discussed earlier. VR ecosystems are not. Metaverse makes social media competitors irrelevant (to a degree, I don’t see a complete replacement).

However, freedom is a long, expensive process. To attain it, Meta has to address one of their biggest opps. Let’s talk about how they’re doing this next.

Part 4: Meta’s Play to Survive the Boom and Bust Cycle.

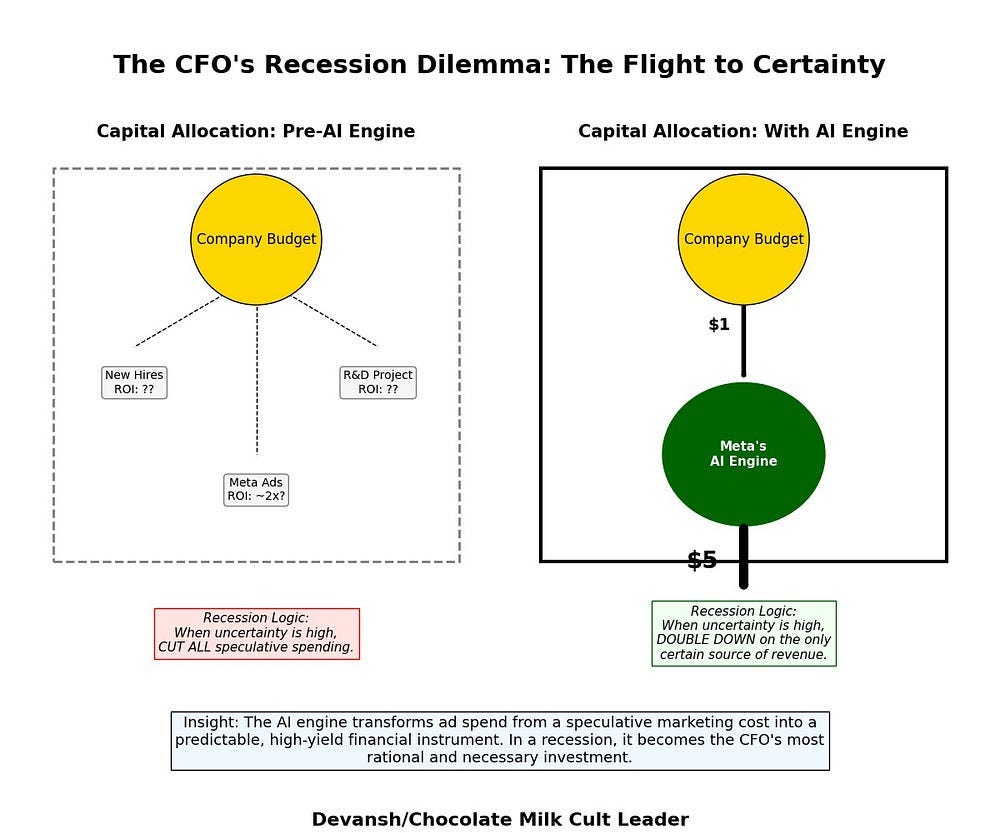

Historically, Meta’s ad revenue was tied to the economic health of a nation. When the economy boomed, ad budgets swelled. When a recession hit, marketing was the first expense to be cut. However, as we flagged in our AI Market Report for May, Meta’s investments into AI-generated ads give them a strong counter-cyclical robustness against downturns. In simple words, when market down, Meta ad profits less down.

The AI Flywheel has fundamentally changed the nature of Meta’s revenue. It has transformed the ad engine from a cyclical luxury into a counter-cyclical necessity. The mechanism is twofold:

AI as a Substitute for Labor: The new generation of AI-powered ad tools allows a single entrepreneur to generate creative that once required an entire marketing team. When a downturn forces companies to cut headcount, they don’t stop advertising. They fire their expensive creative departments and lean more heavily on Meta’s automated engine to generate sales. Meta ceases to be a line item; it becomes a replacement for payroll.

ROI as a Non-Discretionary Expense: The precision of the AI ad engine has made its return on investment so high, and so brutally measurable, that it is no longer a discretionary marketing spend. It is a core driver of revenue. A CFO doesn’t cut the one machine in the building that reliably turns $1 into $5.

When we first covered this, some dismissed it as speculation. However, Meta’s most recent earnings report confirmed this. The average price per ad increased by 9% year-over-year, indicating strong demand despite a tough economy fraught with layoffs, tariffs, and unstable regulation. This was enabled by the clutch numbers by Meta’s AI-driven ad optimization: Instagram ad conversions increased by 5%, and Facebook ad conversions rose by 3%, with cost-per-qualified-lead dropping by 10%.

That flips the historical script. What used to be cyclical weakness becomes counter-cyclical strength. Every downturn drives more reliance on Meta, not less. In a recessionary market, Meta doesn’t shrink. It feeds.

Conclusion: Why Investors Keep Mispricing Meta

So why do investors keep Meta?

Because they are in a community filled with leeches that extract value and rent-seekers, not builders that create it. Consequently, their models are built to value the known world, not look at the world being built. They see the risks of the present with perfect clarity, but they are often blind to the shape of the future being built.

This is the mismatch that explains everything.

They see the 30% Apple tax as a permanent, crippling wound. They fail to see it is the casus belli — the entire motivation for the multi-billion-dollar war for a new, sovereign continent in the Metaverse.

They see the billions burned in Reality Labs as a reckless expense. They cannot comprehend that it is the price of that sovereignty. They are accountants trying to price a revolution.

The concerns around competition for the Metaverse and AI are very valid. However, to negatively price them in this early is premature. These fields are still in very early stages, where the best practices haven’t been defined. More big players here will only grow the ecosystem faster as more ideas can be integrated well.

Having read this, we’re left with only one pressing question — how can you have my babies? Shoot me a message, and we’ll talk.

Thank you for being here, and I hope you have a wonderful day,

I obviously am long on Meta (they’re my top 2 with Nvidia),

Dev <3

If you liked this article and wish to share it, please refer to the following guidelines.

That is it for this piece. I appreciate your time. As always, if you’re interested in working with me or checking out my other work, my links will be at the end of this email/post. And if you found value in this write-up, I would appreciate you sharing it with more people. It is word-of-mouth referrals like yours that help me grow. The best way to share testimonials is to share articles and tag me in your post so I can see/share it.

Reach out to me

Use the links below to check out my other content, learn more about tutoring, reach out to me about projects, or just to say hi.

Small Snippets about Tech, AI and Machine Learning over here

AI Newsletter- https://artificialintelligencemadesimple.substack.com/

My grandma’s favorite Tech Newsletter- https://codinginterviewsmadesimple.substack.com/

My (imaginary) sister’s favorite MLOps Podcast-

Check out my other articles on Medium. : https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Reach out to me on LinkedIn. Let’s connect: https://rb.gy/m5ok2y

My Instagram: https://rb.gy/gmvuy9

My Twitter: https://twitter.com/Machine01776819

I think this is one of the clearer articulations I’ve seen of why Meta keeps being misread rather than mismanaged.

What you get exactly right is that analysts keep trying to value Meta as a revenue stream instead of as a sovereignty project. Once you frame Apple and Google as landlords rather than partners, the Reality Labs spend stops looking like hubris and starts looking like a tax-avoidance strategy at civilisational scale. That shift alone explains most of the persistent mispricing.

I also appreciated the way you treated open source not as ideology but as instrumentation. The “market sonar” framing is accurate and under-discussed. React, PyTorch, and LLaMA function less as products and more as early-warning systems for where developer gravity is moving. Most investors still miss that Meta is effectively outsourcing discovery while internalising only the compounding edge.

Where I would gently push is on timing confidence. The logic of the endgame is sound. The execution risk is not trivial. Owning the stack only pays off if developer lock-in materialises before platform fatigue sets in, and history is not kind to companies betting that users will patiently wait for new continents to emerge. That does not invalidate the strategy, but it does put a premium on capital discipline during the transition.

Overall though, this is strong work. You are analysing Meta as a system of incentives and constraints rather than a bundle of apps, which is how serious capital should be thinking about it. I restacked because more people need to understand that this is not a bet on ads or headsets, it is a bet on who owns the next toll booth.

Thanks heaps, Devansh. An exceptional and deeply thought-provoking read, which I revisited after the recent drawdown to make sure I pay less attention to the noise.